Yole Group Viewpoint – What's next for SiC? The focus is shifting

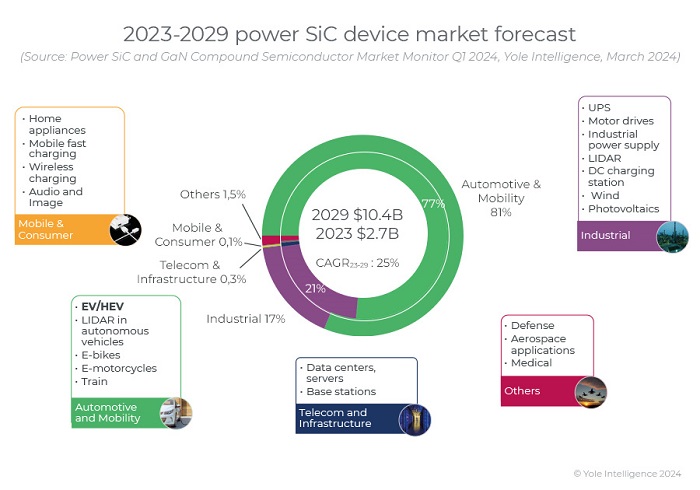

SiC in power electronics is on track to reach $10B in revenue by the end of this decade, and the strong growth in 2023 was a crucial step in multiple applications. BEV remains the key market driver, with Tesla’s 1.8 million cars shipped in 2023 while major OEMs such Hyundai, BYD, Xpeng, Nio and many others are increasingly launching 800V BEVs. All the major SiC device players are supplying this application, helping it achieve record revenue in 2023. In the meantime, other applications, such as EV chargers, power supplies, photovoltaic, etc., are waiting for sufficient volume at a competitive cost for the next generation SiC device designs. It was the same in SiC wafer and epiwafer businesses, with record 2023 revenues.

However, there is a concern that shipments are slowing down due to the weakness of the global economy. Many players are re-evaluating the timing of the return to growth; could it be in Q3 of 2024 or later? The SiC supply chain is closely monitoring it, as 2024 results will be highly impacted.

In the meantime, the supply chain is reshaping. This is seen in the ranking of players by revenue in 2023: Currently, we see at least 2 Chinese companies ranked in the top 5 in SiC wafer and epiwafer. This also indicates the maturity of equipment supply supporting this rapidly growing SiC market.

Another critical consideration is the demand-supply issue. In the past years, SiC wafer was in tight supply; an LTA with a wafer supplier is essential to secure access to SiC wafers. However, following significant capacity expansion in the past 2 years, the discussion is moving to price and the risk of overcapacity. This is the situation the SiC supply chain must manage now, and various strategies will be implemented by the different players. What about the equipment for SiC boules, wafers, epiwafer and dies production? Are there new bottlenecks in the corner of SiC manufacturing industry? Power SiC Manufacturing 2024 covers these points thoroughly.

We also note the supply relationship in our teardown report, as BYD is one of the key OEMs using SiC devices in their BEVs. Will we see more SiC device suppliers entering BYD’s supply chain in 2024 and what will the power module design be? What are the new technology trends seen in discrete and modules? What about main players’ strategy for optimizing SiC product’s bill of materials? Power SiC transistor comparison report addresses these questions. Please see Yole Group’s website for more information.

SOURCE Yole Group