Sivers Semiconductors Enters into Letter of Intent With byNordic Acquisition Corporation for Business Combination of Sivers' Photonics Subsidiary

KISTA, Sweden, Aug. 6, 2024 /PRNewswire/ -- Sivers Semiconductors AB (STO: SIVE), a leading supplier of integrated chips and photonics modules for the most advanced communications and sensor solutions, today announced that the Company has entered into a non-binding letter of intent (the "LOI") to merge its Sivers Photonics Ltd subsidiary ("Sivers Photonics") with byNordic Acquisition Corporation ("byNordic", Nasdaq: BYNO), a publicly-traded special purpose acquisition company. The proposed transaction would create a standalone, publicly traded photonics company that will be funded by significant cash reserves upon completion of the de-SPAC process.

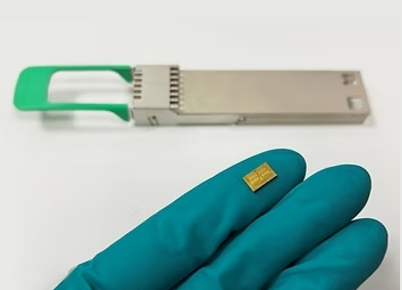

Sivers today consists of two distinct wholly owned subsidiaries addressing two different markets: Wireless and Photonics. The Sivers' Photonics subsidiary is one of the world's advanced suppliers of semiconductor photonic devices. With a particular focus on indium phosphide (InP) laser sources, Sivers Photonics develops customizable lasers aimed at high-growth artificial intelligence infrastructure and sensing applications for data centers, consumer healthcare and automotive LIDAR.

The Sivers' Photonics subsidiary has developed a unique portfolio of technologies underpinned by 25+ years of research and development and has 80 employees, including 12 PhDs. The company has three issued patents and 16 patents pending across the US, UK, Canada and the World Intellectual Property Organization. Additionally, Sivers Photonics currently has development contracts to develop unique, high-performance lasers for several leading SiPh providers, such as Ayar Labs, and is in discussion with several leading AI companies, including hyperscalers.

Subsequent to the proposed spin-off and Sivers Photonics merger combination, Sivers remaining wireless business will consist of a portfolio of leading products in mmWave beamformer front-end integrated circuits, RF transceivers, repeaters, and software algorithms for optimum mmWave RF performance for satellite and 5G Infrastructure. Wireless business net revenue growth was 155 percent in 2023, reaching approximately $15 million. These markets are developing rapidly, and Sivers has secured a number of contracts and design wins that are projected to drive significant product revenue growth over the next 3-5 years.

Sivers Photonics is a leading company within tunable multi-wavelength lasers for direct on-chip integration. According to industry research, the number of sold GPUs for generative AI will grow substantially to approximately 18 million units, which management estimates will result in a total addressable market for chip-to-chip connectivity of $5 billion and a served addressable market of up to $1 billion by 2027. Demand for Artificial Intelligence applications is projected to require staggering increases in processing capability and energy consumption. According to Electric Power Research Institute, data centers could use up to 9% of total electricity generated in the United States by the end of the decade, more than doubling the current consumption. The application of silicon photonics, or SiPh, for data centers is the leading solution with the capacity to deliver the chip-to-chip connectivity needed to remove the bottlenecks for generative AI, while significantly reducing energy consumption. SiPh moves data with light rather than electrons in copper wire, resulting in faster data transmission, lower latency, and up to 90% reduction in power consumption compared to copper wire solutions.

Additionally, consumer biometric sensors using photonic lasers are enabling innovative wearable healthcare products for new applications ranging from tracking personal fitness to monitoring human biometrics and point-of-care solutions. Over the past few years, a single customer has invested over $18M in development contracts with Sivers Photonics to refine and optimize lasers for biometric sensors. While this market remains in its early stages of development, Sivers Photonics' deep R&D expertise has created a unique competitive advantage in supplying sophisticated photonic bio-sensors to this growing market.

"We believe the potential for AI Photonics is immense yet overshadowed by the equally exciting Sivers' Wireless business unit. With the attractive opportunity for silicon photonics in AI infrastructure and the emerging demand for photonic biometric sensors, we feel now is the right time to shine a light on this business unit as a standalone entity to gain access to the U.S. capital markets and create an opportunity for our shareholders to participate in its potential future success," said Bami Bastani, Sivers Semiconductor Chairman. "At the same time, we also look to capitalize on the success of the Sivers' Wireless business unit and the demand for our leading-edge mmWave beamformer solutions for satellite and 5G, which has gained substantial traction with customers in these developing markets over the last several years, enabling us to create a fully fabless and less capital-intensive company that will remain listed under Sivers Semiconductors AB."

This transaction is expected to unlock significant value and create an independent U.S.-listed entity, which will bring Sivers Photonics closer to investors, customers, and partners within the US AI ecosystem. Sivers Photonics currently has approximately 80% of its net revenue in the U.S.

Under the terms of the non-binding LOI, byNordic and Sivers intend to enter into a definitive agreement for the acquisition of Sivers Photonics. The completion of the business combination is subject to the completion of due diligence, the negotiation and execution of definitive documentation and satisfaction of the conditions contained therein, including (i) securing certain concurrent financing, (ii) completion of any required stock exchange and regulatory reviews and (ii) approval of the transaction by byNordic's and Sivers Photonics' Boards of Directors and stockholders. The terms of the proposed transaction provide that Sivers Photonics would be spun out and merged with byNordic, with the former equity holders of both Sivers Photonics and byNordic (following the completion of the Business Combination) holding equity in the combined publicly listed company, with Sivers holding majority ownership in the combined publicly listed company. Once the merger is finalized, the company plans to establish headquarters in Silicon Valley, CA with the manufacturing operations remaining in the U.K.

Sivers management will update this announcement when further clarity on these issues is achieved. In the interim, Sivers management will provide no further comment beyond what is described in the press release, given the sensitivity of the negotiations.

Setterwalls and Pillsbury Winthrop Shaw Pittman LLP are serving as legal counsel for Sivers Semiconductors. Loeb & Loeb LLP is serving as legal counsel for byNordic Acquisition Corporation.

Forward-looking statements:

The information provided herein may include forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such statements include but are not limited to statements regarding Sivers Semiconductors' plans, strategies, goals and business prospects; the terms and conditions of the proposed transaction; the timing of the execution of definitive transaction documents; the anticipation that the proposed transaction will occur; the anticipated benefits of the proposed transaction Sivers Semiconductors and its stockholders as well as to Sivers Photonics; as well as the anticipated business prospects and market trends for Sivers Photonics and its products. These forward-looking statements are based on management's current expectations, estimates, forecasts, and projections about Sivers Semiconductors and Sivers Photonics and are subject to risks and uncertainties that could cause actual results and events to differ materially from those stated in the forward-looking statements, including without limitation, the following: (a) the risks related to the proposed transaction, including without limitation the failure to successfully negotiate or execute definitive transaction agreements, termination of the definitive agreement prior to closing, failure to achieve any of the anticipated closing conditions to the proposed transaction or to fully realize the anticipated benefits of such a transaction, even if the potential transaction occurs, diversion of management's time and attention from our remaining businesses to the divestment of Sivers Photonics, third party costs incurred by us related to any such transaction, and risks associated with any liabilities related to the transaction or any such assets or business that are retained by Sivers Semiconductors in any sale transaction; (b) risks and uncertainties related to current expectations with respect to the combined businesses of Sivers wireless business and Sivers Photonics prior to the transaction and after the transaction, if it is consummated; and (c) other risks and uncertainties discussed in the other public disclosures available from Sivers Semiconductors. Forward-looking statements contained in this press release are made only as of the date hereof, and Sivers Semiconductors undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

For more information, please contact:

Dr. Bami Bastani, Chairman of the Board

Tel: +1 908 87 28 370

E-mail: bami.bastani@sivers-semiconductors.com

byNordic Investor Relations Contact:

Shelton Group Leanne K. Sievers | Joel Achramowicz

E-mail: sheltonir@sheltongroup.com

This disclosure contains information that Sivers Semiconductors is obliged to make public pursuant to the EU Market Abuse Regulation (EU nr 596/2014). The information was submitted for publication, through the contact person set out, on August 6, 2024, 22:30CET.

Sivers Semiconductors AB (SIVE.ST) is a leader in SATCOM, 5G, 6G, Photonics, and Silicon Photonics that drives innovation in global communications and sensor technology. Our business units, Photonics and Wireless, supply cutting-edge, integrated chips and modules critical for high-performance gigabit wireless and optical networks. Catering to a broad spectrum of industries from telecommunication to aerospace, we fulfill the increasing demand for computational speed and AI application performance, replacing electric with optical connections for a more sustainable world. Our wireless solutions are forging paths in advanced SATCOM/5G/6G systems, while our photonics expertise is revolutionizing custom semiconductor photonic devices for optical networks and optical sensing, making us a trusted partner to Fortune 100 companies as well as emerging unicorns. With innovation at our core, Sivers Semiconductors is committed to delivering bespoke, high-performance solutions for a better-connected and safer world. Discover our passion for perfection at www.sivers-semiconductors.com.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/sivers-semiconductors/r/sivers-semiconductors-enters-into-letter-of-intent-with-bynordic-acquisition-corporation-for-busines,c4021562

The following files are available for download:

https://mb.cision.com/Main/11695/4021562/2935262.pdfSivers PR-Final Aug-6-2024 for 22.30 Eng version

SOURCE Sivers Semiconductors