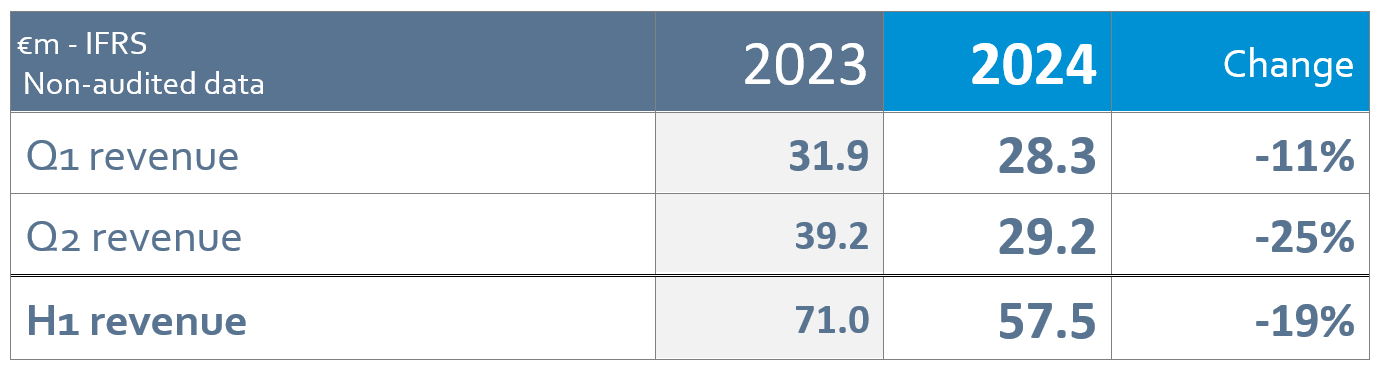

Ekinops H1 2024 revenue: 57.5 m€

Ekinops (Euronext Paris - FR0011466069 – EKI), a leading supplier of telecommunications solutions for telecom operators and enterprises, reports its Q2 2024 revenue (April 1 to June 30, 2024).

In Q2 2024, Ekinops reported consolidated revenue of 29.2 m€, down compared to Q2 2023 (-25%)as anticipated. The trend is identical at constant exchange rates.

On a sequential basis, Q2 2024 revenue was up +3% relative to Q1 2024.

Over H1 2024, Ekinops’ revenue came to 57.5 m€, down -19% compared with H1 2023 (identical at constant exchange rates).

Access up +1%, Optical Transport down -41% over H1

At the end of H1 2024, sales of Access solutions were up +1% compared to the same period last year, driven by the rebound in sales in France (+16% over the semester), after the decline in 2023. New inventory rebuilding of Access equipment at Ekinops’ main customers continued gradually, without returning to normative levels.

Sales of Optical Transport solutions were down -41%, after a record year in 2023 (+41% growth in H1 2023 and +27% for the full year)

Beyond this significant base effect, this business line has been excessively penalized since H2 2023 by (i) cautious investment policies by operators carrying high levels of inventory and seeking to reduce their CAPEX (capital expenditure) in an environment of high interest rates, (ii) less buoyant internet traffic growth since 2023 (absence of new use cases since the COVID crisis, data optimization thanks to compression technologies, low pace of 5G roll-out, etc.) in a context of overcapacity. The emergence of generative artificial intelligence and the development of virtual reality equipment (virtual reality headsets) now constitute new use cases which should enable a new phase of growth in internet traffic over the coming years.

Furthermore, the delayed launch, now effective since the end of Q2 2024, of the new 800G optical solution (800 gigabits per second) led to a wait-and-see attitude among many Ekinops customers to benefit from this new solution for their deployments.

Software & Services accounted for 17% of half-year revenue (vs. 14% a year earlier and 17% for FY2023), with an increasing share of recurring revenue, in particular for the SD-WAN solution.

Revenue up +5% in France, down -31% internationally

H1 2024 saw buoyant business trends in Ekinops’ home market, with half-year revenue up +5%.

France, which accounts for 44% of Ekinops’ total business volumes (vs. 32% for FY 2023), benefited from a rebound in Access sales (+16%), which represented more than 90% of Ekinops’ business in France over the period. Sales of Transport solutions were down sharply, by -48%, after the strong +108% growth in H1 2023 and a +57% for full year 2023.

Ekinops’ international business was down -31% over the period, representing 56% of total half-year revenue (vs. 68% for FY 2023).

In North America, where business is almost exclusively generated by Optical Transport solutions, sales amounted to 12.6 m€ in H1 2024, down -31% vs. H1 2023 (almost identical in US dollars), which represented a high comparison base (+42% growth in business). The US market is marked by a significant wait-and-see attitude adopted by service providers, linked to the slow deployment of the 42 billion dollars federal BEAD program (Broadband Equity, Access and Deployment), aimed at reducing the digital divide in the US by promoting the deployment of fiber optic networks to provide rural and remote areas with high-speed access. North America represented 22% of Group business in H1 2024 (vs. 25% for FY 2023).

Half-year sales were down -32% in EMEA (Europe - excluding France - middle East & Africa), mainly penalized by the sharp decline in Optical Transport sales, after the strong growth in 2023, notably in Germany and Eastern Europe. The EMEA region accounted for 32% of total business activity in H1 2024 (vs. 41% for FY 2023).

Asia-Pacific, which accounted for 2% of Group business activity in H1 2024 (identical level to FY 2023), reported revenue of 1.3 m€, down -15%. However, it should be noted that Q2 2024 saw a +32% rebound in business volumes, driven mainly by growth in sales of Optical Transport equipment.

1.8 m€ subsidy granted by the French government as part of the “ORANGE MECT PART” project

Ekinops announces it has obtained a 1.8 m€ subsidy, granted by the French government and Bpifrance as part of the “Projets innovants d’envergure européenne ou nationale sur le renforcement d’une filière électronique française ou européenne” initiative.

This funding was granted to Ekinops as part of the “ORANGE MECT PART” major project of common European interest (PIIEC) initiative, developed in collaboration with Orange and its partners, to provide innovative connectivity solutions for specific configurations or digital deserts, as an alternative to current transmission solutions.

At Orange’s initiative, “ORANGE MECT PART” aims to develop concrete solutions for the next decade,

by creating and deploying secure and sustainable digital infrastructures via “5G everywhere”.

This financing is part of the France 2030 plan, an ambitious government plan launched in 2021 with a budget of 54 bn€, aimed at sustainably transforming key sectors of the French economy (energy, industry, transport, agriculture, food, digital, etc.) through innovation.

Outlook

With overall of economic slowdown, Q2 2024 activity followed the trend of previous quarters, with revenues around 28 m€/30 m€ for the four consecutive quarters.

In Access, inventory easing continued at operators in France in Q2, leading to a slight growth over the semester. The Group aims to accelerate this trend in H2 2024, in France but also in the EMEA region, conditional on the strength of the economic recovery.

In Optical Transport, the launch of the new 800G product with differentiating features and a 100G solution offering greater competitiveness should help boost sales over the coming semesters.

In this context, Q3 2024 should be in line with the four previous quarters. Ekinops anticipates an improvement of the trend starting in Q4 2024.

In terms of external growth, Ekinops remains committed to complete one or more operations to consolidate its R&D clout, strengthen its offering and round out its customer base, favoring a non-dilutive source of financing.